CM Punjab Asaan Karobar Finance Scheme 2025: Interest-Free Loan Up to 3 Crore

Many small and medium enterprises struggle to arrange finances for their businesses with high-interest loans. But the government of Punjab, under the supervision of CM Maryam Nawaz Sharif, made a revolutionary initiative to help small trades and startups. By offering interest-free loans of up to 30 million rupees with an easy repayment schedule, it is a game-changing scheme for startups. It is named as CM Punjab Asan Karobar Finance Scheme 2025.

What is the CM Punjab Asaan Karobar Finance Scheme?

The Akf Punjab scheme 2025 is one of the best initiatives taken by the government of Punjab in this tenure to boost the economy of Pakistan and create opportunities for the youth of Punjab. It offers interest-free loans up to 3 crore (30 million PKR). It will be provided to small enterprises and startups with proper business ideas across various sectors. It will help in economic development and business growth in Punjab.

The Punjab Asan Karobar Finance scheme was announced at the 22nd Provincial meeting. CM Punjab Maryam Nawaz Sharif approved the scheme and asked for a transparent selection and disbursement of the loan. Moreover, a target was set to establish 100,000 business start-ups in Punjab. She was also directed to provide business plans for start-ups across the state.

Goals of the Asaan Karobar Finance Scheme

These are the ultimate goals of the Asan Karobar Finance Scheme 2025 announced by the Government of Punjab. It can lead to a progressive cycle in the future for Pakistan.

- Boost Economic Development

- Empower Small businesses and startups

- Create jobs and opportunities

- Offering financial assistance through an easy and streamlined registration process.

- Boosting Export Power

- Modernising and growing an existing business

- Helping new businesses to start

- Climate-friendly businesses using Resource Efficient and Cleaner Production (RECP) technologies.

Benefits of Asaan Karobar Finance Scheme

The following are the benefits of the Asan Karobar Finance Scheme:

- Interest-free Loans Up to 30 Million rupees

- Flexible Repayment Options: Payments are made over 24 months with a grace period of 3 months.

- Will provide financial support to small entrepreneurs to drive their business

- It will boost local economic growth and also help in exports.

Additional Incentives

Some additional incentives are also part of the scheme, which can help successful applicants during the loan period.

- Rs. 5 million capital subsidy for solar equipment and production technologies to make the business climate-friendly.

- Non-financial advisory services for the development of new small industrial states.

- Long-term leases of up to 30 years are used to avoid the high land acquisition costs.

Eligibility Criteria for Asan Karobar Finance Scheme

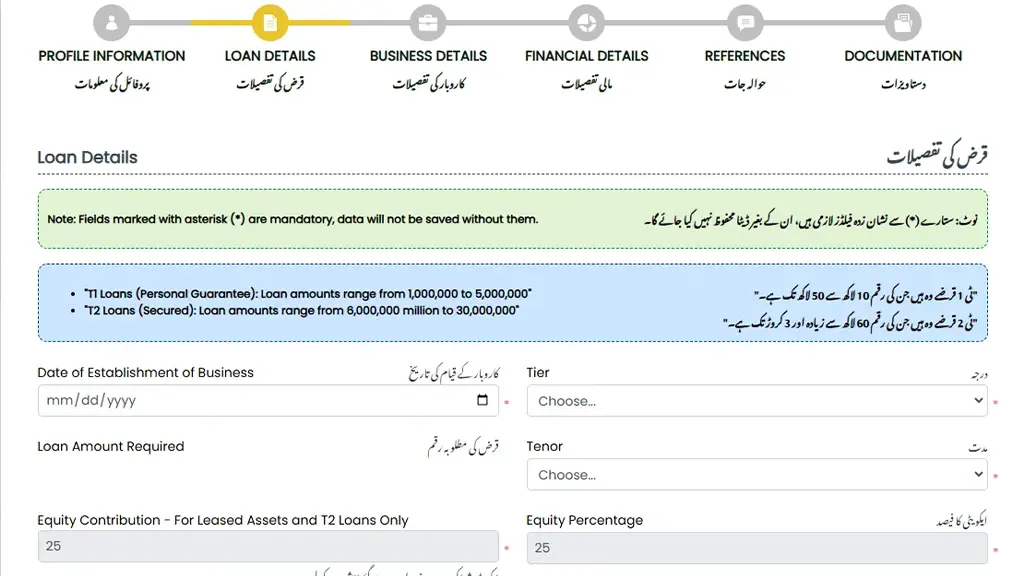

The scheme is based on and classified into two tiers on the basis of loan amount. The first tier needs only a personal guarantee and can get a loan of up to 5 million rupees. Tier 2 can avail a loan of up to 30 million rupees. Applicants must meet the following eligibility criteria for the scheme.

- Must be a resident of Punjab, and the business should be located in Punjab.

- Valid CNIC and Tax No. (NTN)

- Must be an active FBR tax filer.

- Age must be between 25 and 55 Years

- Small enterprises with annual sales up to PKR 150 million

- Medium enterprises with annual sales up to 150-800 million PKR.

- Must have a clean credit History

- Must have his own or have rented the place of an existing business.

- Must be able to pay installments easily.

Loan Details

This table shows loan details for both tiers.

| Tier 1 | Tier 2 |

| Amount pkr: 1-5 million pkr | Amount pkr: 6-30 million pkr |

| Security: Personal Guarantee | Security: Secured |

| Tenure: Up to 5 Years | Tenure: Up to 5 Years |

| End-user Rate: 0% | End-user Rate: 0% |

| Processing fee: 5000 PKR | Processing fee: 10000 PKR |

Note: The grace period is up to 6 months for newly established businesses and up to 3 months for existing businesses.

Equity Contribution

- 0 % for T1 other than leased commercial vehicles

- Leased Vehicles: 25%

- Other Loans: 20% in all other cases under T2

- 10% for females, transgender, and differently-abled persons

Additional Costs

- Insurance, legal, and registration charges apply.

- 3% pa for existing business

- Nil for climate-friendly businesses T2 only

Repayment Terms

- Equal monthly installments for a given period.

- A grace period of 3 months for businesses

- Minimal late charges

Where Can You Use the Loan?

- Expanding your existing business by purchasing new gear

- You can set up your new office.

- Purchasing Raw Materials, buying the needed resources for manufacturing

- Expanding workforce by hiring more employees on a salary basis

Asaan Karobar Finance Scheme Apply Online (Step-by-Step)

Make Sure you have

- Valid CNIC

- Two references other than blood relatives

- You should be an active Tax Filer.

- You should have a complete roadmap for your business

- You should have non-refundable fees.

Step 01: Click the Apply button

Visit the official website and click on the apply button on the Asaan Karobar finance scheme. First, read all the details carefully. And add simple details for signing up for the portal. Now click on Acknowledge and Continue, and then you will be directed to the homepage.

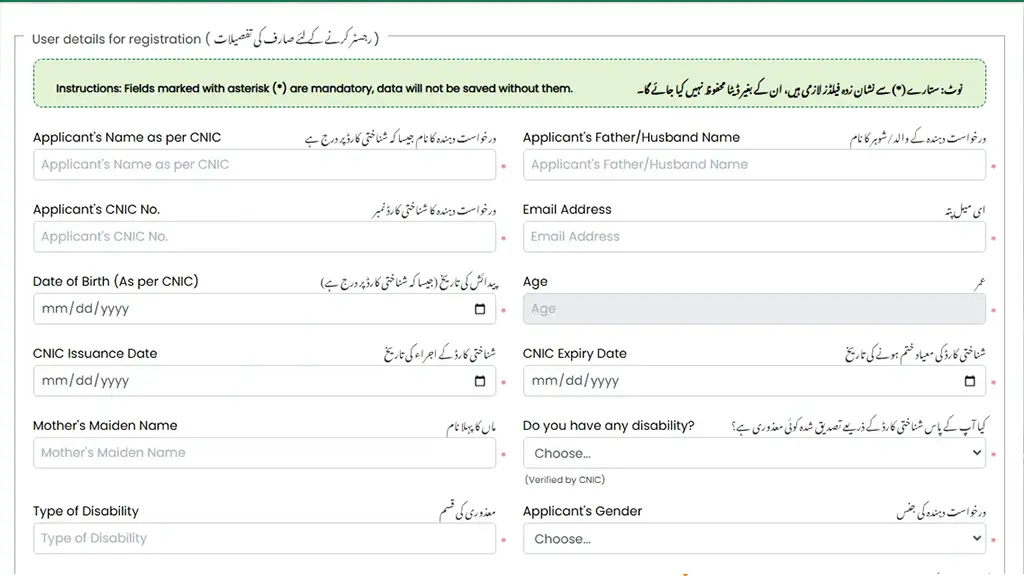

Step 02: Profile Information

Now, put in your profile details like CNIC and NTN. There are also other sections related to your details. Read carefully and fill in the details in the application. Carefully fill in the details of the application. Fill in all details carefully. You also have to give the CNIC of your father.

Step 03: Loan Details

Now add the loan details for which you are applying. Tier 1 will get up to 5 million rupees, and Tier 2 will be able to get up to 30 million rupees. So read carefully and fill in the details accordingly. So read carefully and fill in the details accordingly. You have to add the required loan amount and the date of establishment of the business.

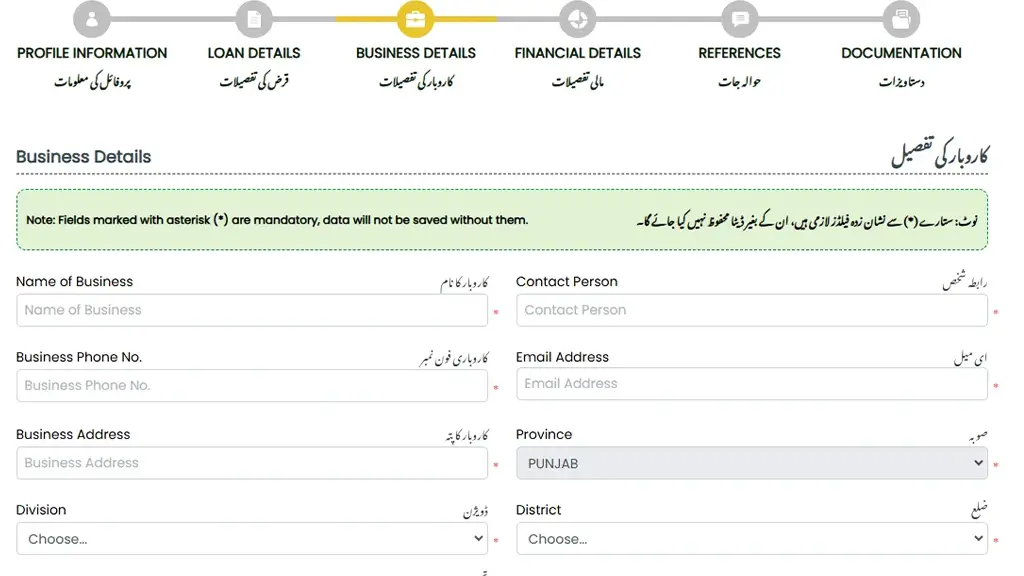

Step 04: Business Details

Now you have to add your business details. It is the most important section when applying for a loan. You have to give the right details that are easily available to verify. Business details include business premises, your business NTN, and expenses. So, with wrong data, your application will be denied after verification.

Step 05: Financial Details

Now you have to put in financial details. You must have a clean credit record. And according to the eligibility criteria,

- Small enterprises with annual sales up to PKR 150M

- Medium enterprises with annual sales > PKR 150M – PKR 800M are eligible.

Step 06: Guarantee

Tier 1 includes a personal guarantee duly signed by the applicant. But in Tier 2, you have to give references to avail of the loan. Two references are required to avail the loan. References should not be blood relatives. They have to provide their CNIC and Guarantee.

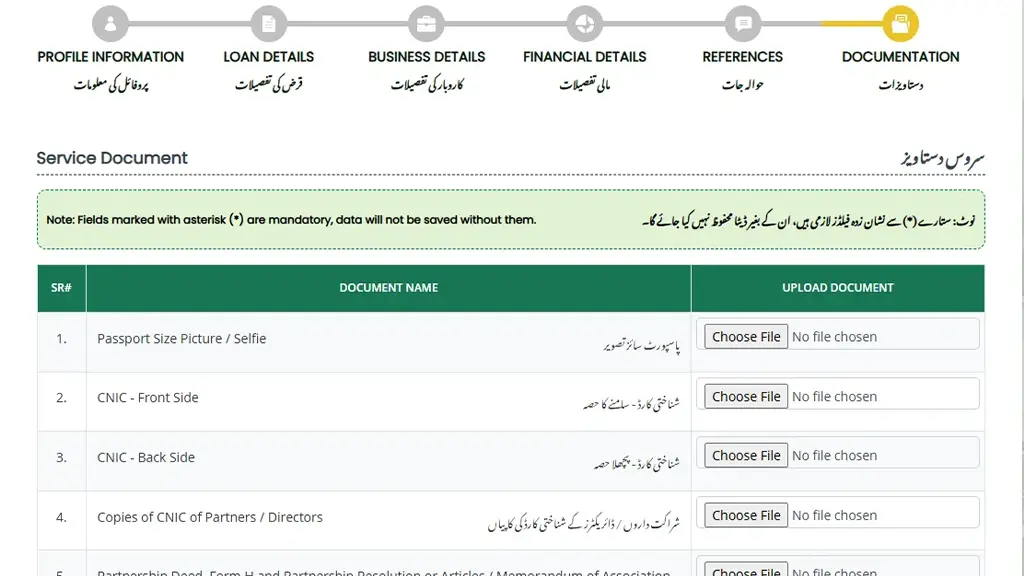

Step 07: Documentation

It is the final and most important step of the Asan Karobar portal. Upload all required documents in the upload section of the portal. You have to upload your CNIC, your bank details, and other required documents.

Step 08: Pay Fees

Now, make sure to pay the fees, which are 5000 rupees for Tier 1 and 10000 rupees for Tier 2. It is non-refundable. Check for paid status on the portal to verify if your fees are paid or not.

Avoid These Common Mistakes While Applying

Merit list of the scheme

The merit list of AKC Punjab will be displayed after successful verification of details by the respective departments. You will be notified through SMS, and you can also check your Asan Karobar finance application status by logging in to the portal. Successful applicants will undergo further verification, and then a loan will be provided to them.

Transparent Selection

CM Punjab Maryam Nawaz Sharif asked for transparent and merit-based selection for loan applicants. So these are strict orders to ensure transparency in the AKC scheme. So there will be a clear selection of applicants.

Latest Updates & Changes in the Scheme (2025)

- Easy Application Process: The application approval process is fast and simplified.

- Reduce disbursement period: Loan applicants will receive funds more quickly.

- Equal Monthly Installments: There will be equal monthly installments for 24-month periods.

Helpline Number of AKC

- There is a helpline number available, 1781, provided by the Government of Punjab.

- Applicants can call this helpline for their queries. You can also check application status by calling the helpline.

CM Punjab Maryam Nawaz

CM Punjab Maryam Nawaz Sharif is working hard for the economy of Punjab and Pakistan. She has announced many great initiatives for youth. She has been the Chief Minister since February 26, 2024. Her mission is to develop a healthy, sustainable, safe, and prosperous Punjab in which each citizen is empowered, educated, and has social and global mobility. She is doing wonderful work in Punjab.

Along with Asaan Karobar Finance, CM Punjab had also announced the Asaan Karobar Card for small entrepreneurs and startups. You can easily log in to the portal by using this guide and also check the Asaan Karobar Card application status.

FAQs

Conclusion

The Punjab Asaan Karobar Finance Scheme 2025 is a great opportunity for businessmen and proprietors of Punjab. If you are planning to start a new business or expand your business, this is a good opportunity for you to avail of a loan and fulfill your economic deficiencies. And it comes with an easy repayment schedule, so it is easy for you to pay it back. It is a great initiative by the Government of Punjab and can help in employment and job opportunities creation.